When it comes to protecting payment card information and other sensitive data, PCI compliance is essential. The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements created by the Payment Card Industry Security Standards Council (PCI SSC) to ensure that all organizations that process, store, or transmit credit card information maintain a secure environment. PCI compliance is not only necessary for the safety of customers, but it is also a legal requirement.

PCI compliance is determined by a series of 12 requirements that must be met in order to be compliant. These requirements are designed to protect cardholder data, secure networks, and ensure the security of systems and processes.

The requirements are divided into six categories, including: building and maintaining a secure network, protecting cardholder data, maintaining a vulnerability management program, implementing strong access control measures, regularly monitoring and testing networks, and maintaining information security policies.

By understanding the PCI compliance requirements, organizations can ensure that their systems are secure and that their customers’ information is protected. This article will provide an overview of the PCI DSS, the different levels of compliance, and how to ensure your business is compliant with PCI regulations.

What Is PCI?

PCI Compliance, or Payment Card Industry Data Security Standard (PCI DSS), is a set of security standards developed by the Payment Card Industry Security Standards Council (PCI SSC) to ensure the safety of credit and debit card transactions. The PCI DSS is a global standard that applies to all organizations that process, store, or transmit payment card information. The standards are designed to protect cardholder data, reduce fraud, and ensure the security of payment card transactions.

The PCI DSS is a comprehensive set of requirements for organizations to protect cardholder data. The standards cover areas such as network and system security, access control, encryption, authentication, and monitoring and logging. Organizations must meet the requirements of the PCI DSS in order to be compliant with the standard. This includes:

- Self-Assessment Questionnaire: Organizations must complete a Self-Assessment Questionnaire (SAQ) to demonstrate their compliance with the PCI DSS. The SAQ is a questionnaire that outlines the requirements of the PCI DSS and asks organizations to provide evidence of their compliance. The SAQ is used to assess an organization’s security posture and to identify any areas that may need to be addressed.

- Report on Compliance: Organizations must also complete a Report on Compliance (ROC) to demonstrate their compliance with the PCI DSS. The ROC is a document that outlines the findings of a security assessment conducted by a qualified security assessor. The ROC is used to confirm that an organization has met all of the requirements of the PCI DSS.

- PCI DSS Compliance: Organizations that process, store, or transmit payment card information must comply with the PCI DSS in order to protect cardholder data and reduce the risk of fraud.

What Is The PCI Data Security Standard?

The Payment Card Industry Data Security Standard (PCI DSS) is an information security standard for organizations that handle credit card and debit card information. It was created by the Payment Card Industry Security Standards Council (PCI SSC) to protect cardholder data and reduce credit card fraud. The PCI DSS is a set of requirements designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment.

The PCI DSS is made up of 12 requirements that must be met in order to be compliant. These requirements are divided into six categories:

- Build and Maintain a Secure Network: This requirement includes measures to protect networks from unauthorized access and to secure data transmission.

- Protect Cardholder Data: This requirement includes measures to protect cardholder data from unauthorized access, use, and disclosure.

- Maintain a Vulnerability Management Program: This requirement includes measures to identify and address vulnerabilities in systems that could be exploited by attackers.

- Implement Strong Access Control Measures: This requirement includes measures to ensure that only authorized personnel have access to cardholder data.

- Regularly Monitor and Test Networks: This requirement includes measures to regularly monitor and test networks for vulnerabilities.And monitor traffic for breaches in the system. Investigate possible security breaches and report finding to the appropriate authorities.

- Maintain an Information Security Policy: This requirement includes measures to ensure that all personnel are aware of and adhere to security policies and procedures.

The PCI DSS is designed to ensure that organizations are taking the necessary steps to protect cardholder data. By meeting the requirements of the PCI DSS, organizations can reduce the risk of credit card fraud and protect their customers’ data.

Benefits Of PCI Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect companies and customers from any potential risks associated with the handling of credit card and debit card information. Compliance with the PCI DSS is mandatory for all organizations that process, store, or transmit credit card information. However, it is the organization’s responsibility to ensure that their systems and processes are compliant with the PCI DSS.

The benefits of PCI compliance are numerous, and include increased customer confidence, improved security, and reduced risk of data breaches. By adhering to the PCI DSS, organizations can protect customer data, reduce the risk of fraud, and protect their own reputation.

When organizations are compliant with the PCI DSS, customers can be assured that their personal information is secure and that their credit card information is safe. This increased customer confidence and trust can lead to increased customer loyalty and repeat business.

Organizations that are compliant with the PCI DSS also benefit from improved security. The PCI DSS requires organizations to implement measures that protect data from unauthorized access, use, and disclosure. These measures include encryption, firewalls, access control, and regular security testing.

Finally, organizations that are compliant with the PCI DSS can reduce the risk of data breaches. The PCI DSS requires organizations to take measures to protect customer data, such as encrypting data, monitoring access to systems, and regularly testing security measures. By taking these measures, organizations can reduce the risk of a data breach and the associated costs.

Overall, the benefits of PCI compliance are numerous and can help organizations protect customer data, reduce the risk of fraud, and protect their own reputation. By adhering to the PCI DSS, organizations can ensure that their systems are more secure, customer data is better protected, and customer confidence is increased.

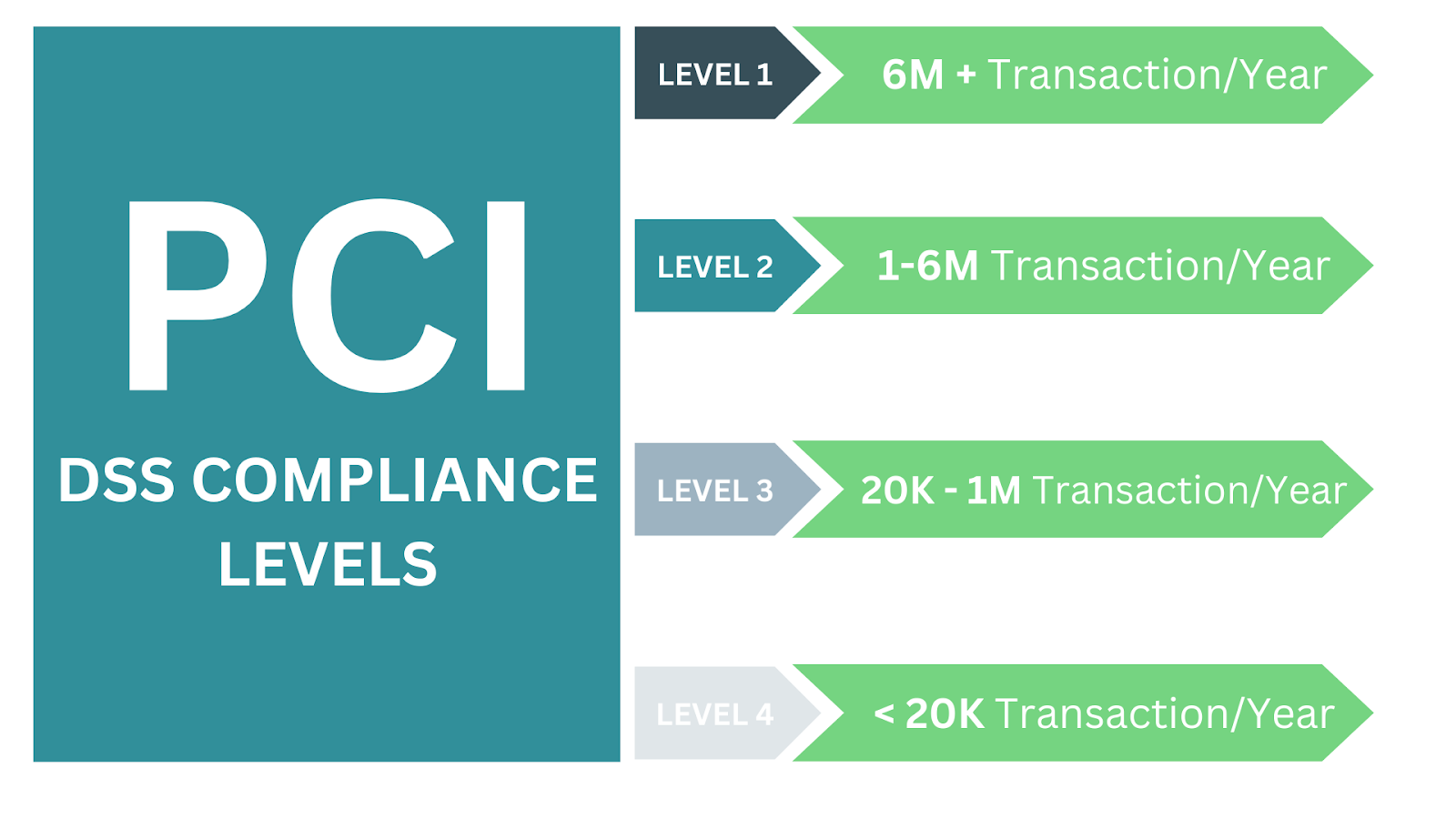

How Are The PCI Compliance Levels Determined?

The Payment Card Industry (PCI) compliance levels are determined by the number of transactions that a business processes per year. The higher the number of transactions, the higher the PCI compliance level required. The four levels of PCI compliance are:

Level 1 is the highest level of PCI compliance and is required for businesses that process over 6 million transactions per year. Level 1 requires an annual on-site audit and a quarterly external scan, as well as other security measures.

Level 2 is required for businesses that process between 1 and 6 million transactions per year. Level 2 requires an annual self-assessment questionnaire, as well as other security measures.

Level 3 is required for businesses that process between 20,000 and 1 million transactions per year. Level 3 requires a quarterly external scan, as well as other security measures.

Level 4 is the lowest level of PCI compliance and is required for businesses that process less than 20,000 transactions per year. Level 4 requires an annual self-assessment questionnaire, as well as other security measures such as plus 4 scans.

It is important for businesses to understand the PCI compliance levels and the associated requirements in order to ensure their payment processing systems are secure and compliant.

By understanding the PCI compliance levels, businesses can ensure they are meeting the necessary requirements and protecting their customers’ data.

The 12 PCI Compliance Requirements

The Payment Card Industry Data Security Standard (PCI DSS) is designed to ensure that businesses that accept, process, store, or transmit credit card information maintain a secure environment. These requirements are designed to protect cardholder data and reduce the risk of a data breach.

- Build and Maintain a Secure Network: This requirement includes firewalls and other security measures to protect cardholder data.

- Protect Cardholder Data: This requirement includes measures to protect data such as encryption, access control, and other measures to ensure that only authorized personnel can access cardholder data.

- Maintain a Vulnerability Management Program: This requirement includes measures to identify and remediate security vulnerabilities in systems, applications, and networks.

- Implement Strong Access Control Measures: This requirement includes measures to ensure that only authorized personnel can access cardholder data.

- Regularly Monitor and Test Networks: This requirement includes measures to monitor and test networks for security vulnerabilities and to ensure that security controls are functioning properly.

- Maintain an Information Security Policy: This requirement includes measures to ensure that all personnel are aware of and adhere to the security policy.

- Restrict Physical Access to Cardholder Data: This requirement includes measures to restrict physical access to cardholder data.

- Identify and Authenticate Access to Cardholder Data: This requirement includes measures to identify and authenticate personnel who are authorized to access cardholder data.

- Restrict Access to Cardholder Data: This requirement includes measures to ensure that only authorized personnel can access cardholder data.

- Track and Monitor All Access to Cardholder Data: This requirement includes measures to track and monitor all access to cardholder data.

- Regularly Test Security Systems and Processes: This requirement includes measures to regularly test security systems and processes to ensure that they are functioning properly.

- Maintain an Incident Response Plan: This requirement includes measures to ensure that there is a plan in place to respond to security incidents.

By following these 12 requirements, businesses can ensure that they are compliant with PCI DSS and that they are taking the necessary steps to protect cardholder data.

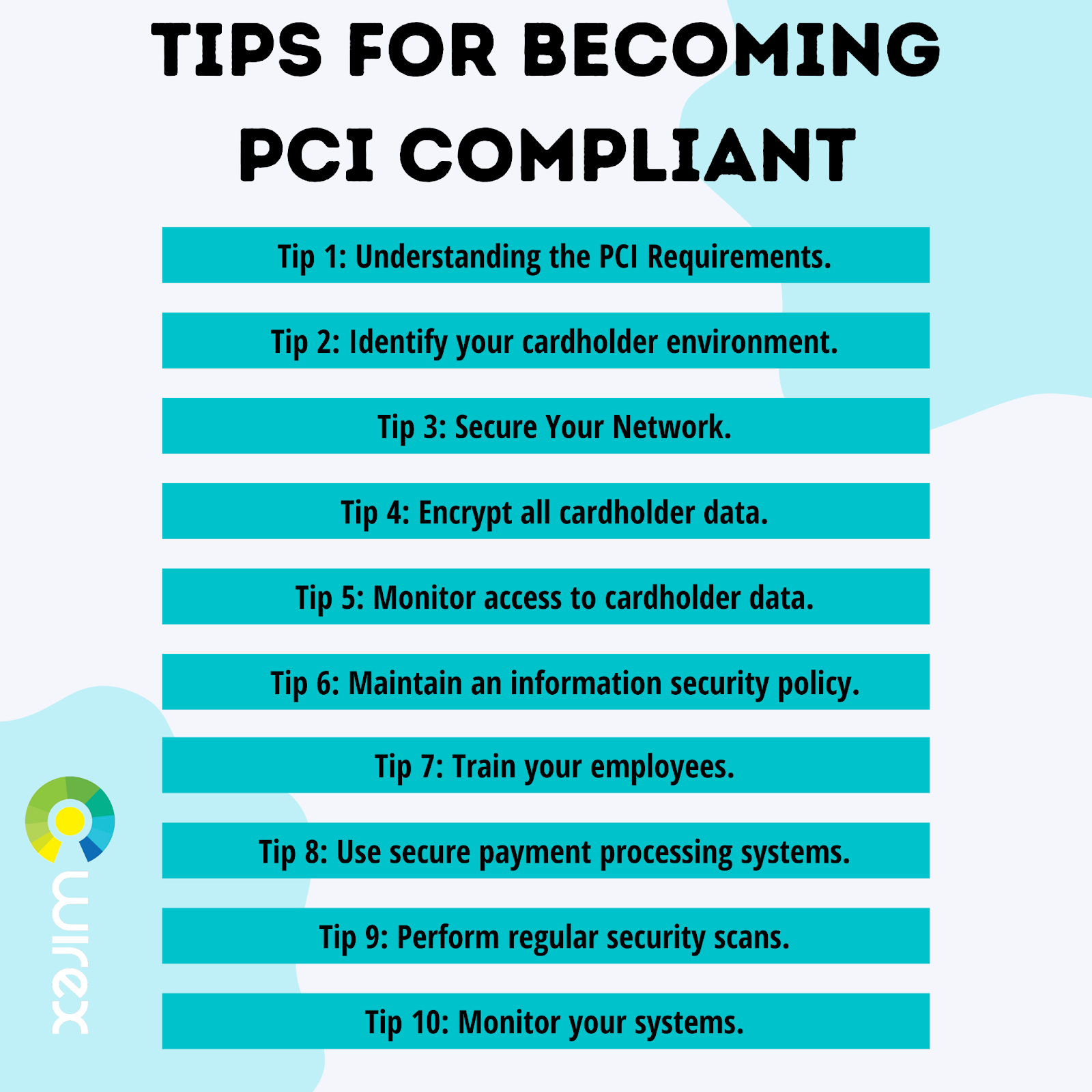

Tips For Becoming PCI Compliant

Becoming PCI compliant is an important step for any business that processes credit card payments. It can help protect your customers’ data and ensure that your business is compliant with industry regulations. Here are some tips to help you become PCI compliant:

- Understand the PCI requirements. Make sure you understand the 12 PCI requirements and how they apply to your business.

- Identify your cardholder data environment. You need to know where your cardholder data is stored, how it is transmitted, and who has access to it.

- Secure your network. Make sure your network is secure by using firewalls, antivirus software, and other security measures.

- Encrypt data. Encrypt all cardholder data, both at rest and in transit, to protect it from unauthorized access.

- Monitor access to cardholder data. Monitor who has access to cardholder data and when, and make sure access is restricted to those who need it.

- Maintain an information security policy. Develop an information security policy that outlines your security measures and is regularly reviewed and updated.

- Train your employees. Make sure your employees understand the importance of PCI compliance and how to protect cardholder data.

- Use secure payment processing systems. Use payment processing systems that are PCI compliant to ensure your customers’ data is secure.

- Perform regular security scans. Regularly scan your systems for vulnerabilities and take steps to fix any issues that are identified.

- Monitor your systems. Monitor your systems for suspicious activity and take steps to protect your customers’ data if any is detected.

Following these tips can help you become PCI compliant and protect your customers’ data. Make sure you understand the PCI requirements and take steps to ensure your business is compliant.

Final Thoughts

PCI compliance is an important step for businesses that accept credit and debit cards to ensure the security of customer data. With the 12 requirements of the PCI DSS, businesses can ensure that their payment processing systems are up to date and secure.

By understanding the different levels of compliance and following best practices, businesses can protect their customers and themselves from fraudulent activity. With the right knowledge and resources, businesses can be confident that they are compliant with PCI standards and more secure their customer’s data.

You can learn more about how our technology works, but we also have a Whitepaper on the top 3 requirements to turbocharge your incident response.

And, as always, reach out to us, and we’ll discuss how to best support your business for the future.

FAQs

What is PCI compliance?

PCI Compliance is a set of security standards developed by the Payment Card Industry (PCI) Security Standards Council to ensure that businesses that accept credit and debit cards protect their customers’ data.

The PCI Data Security Standard (DSS) provides a framework of requirements that must be met in order to be compliant with the PCI standards.

What are the requirements of PCI Compliance?

The requirements of PCI Compliance are divided into 12 different categories. These categories include: maintaining a secure network, protecting cardholder data, maintaining a vulnerability management program, implementing strong access control measures, regularly monitoring and testing networks, and maintaining an information security policy.

Each requirement has its own set of specific requirements that must be met in order for a business to be PCI compliant.

How do I know if my business is PCI compliant?

In order to be PCI compliant, businesses must submit a Self-Assessment Questionnaire (SAQ) to the PCI Security Standards Council. This questionnaire will assess the security of the business’s data systems and processes. Passing the assessment is the first step in being considered PCI compliant, as well as a few other steps.

What happens if I’m not PCI compliant?

If a business is not PCI compliant, they may be subject to fines and other penalties from the credit card companies. In addition, they may be liable for any fraud or data breaches that occur due to their lack of compliance.

How often do I need to be PCI compliant?

The PCI Security Standards Council requires businesses to be PCI compliant on an ongoing basis. Businesses must submit their SAQ annually and must also complete quarterly scans of their systems to ensure they are compliant.